Proforma Invoice

A Proforma Invoice is actually an invoice that is used to provide an estimate or proposal and is subject to change. This is different from a commercial invoice, which is the final and official invoice and is used for customs declarations.

What is a proforma invoice used for?

At the start of a new export supply order, the seller prepares and sends a proforma invoice to its buyer to confirm the order details. During the trading process, the exporter usually requires an advance payment to confirm the order and begin production of the goods. A common example is to pay 30% in advance and pay the balance of 70% after the goods have been produced or shipped (specific terms to be agreed upon between buyer and seller).

Please note that proforma invoices are issued prior to shipment, i.e. before the goods are produced or delivered. Once the goods are produced and ready to ship, sellers will request the remaining amount for payment via a proforma invoice or commercial invoice. A commercial invoice is usually issued after delivery of goods and contains the actual quantity of the final product and the amount of the balance due to be used by the importer during the customs clearance process.

How does a Proforma Invoice work with a Purchase Order?

These two documents are essentially the same, however, sometimes the quantity of goods shown on the commercial invoice may differ from the quantity of goods shown on the proforma invoice. This is because the quantity of items ordered may differ from the actual quantity of items shipped.

This difference can be caused by many reasons, but the most common is that the supplier experienced production problems or delays, or the supplier did not properly plan how many items would fit into the shipping containers. It is because of this discrepancy that a commercial invoice is typically issued after the goods have been delivered or shipped to ensure that it accurately reflects the final quantity of goods shipped.

How does a proforma invoice work with a receipt of a purchase?

A proforma invoice is usually issued by the seller upon receipt of a purchase order from the buyer. These are important documents that are used to officially confirm all order and product information to avoid confusion or problems with product supply and delivery. These documents may include any additional information agreed upon between the buyer and seller.

Both parties will be required to sign each document as it represents a legally binding agreement between the buyer and seller. In the event of any disputes related to the order or delivery of goods, these documents will be submitted to court.

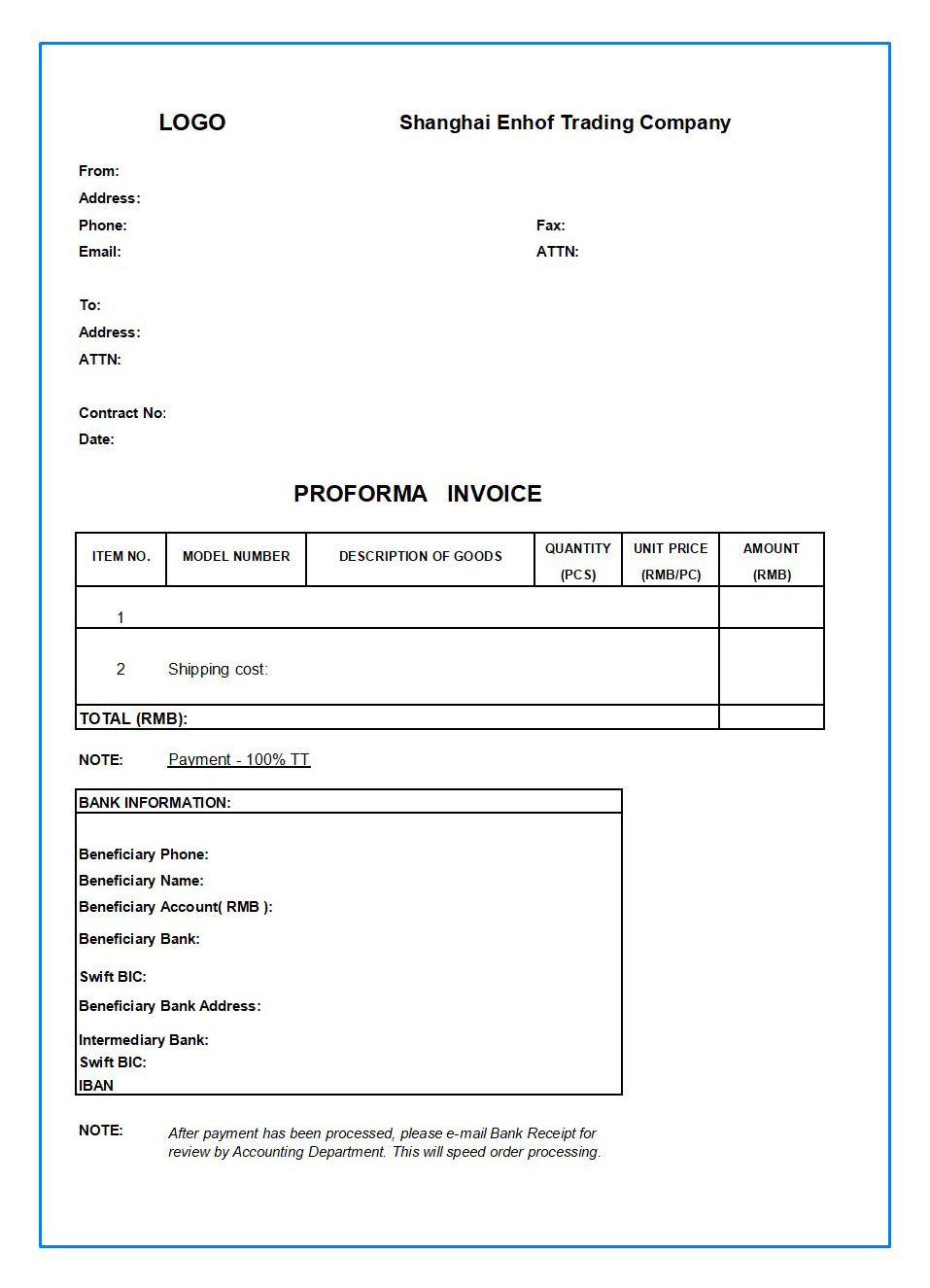

What information is contained in the Proforma Invoice?

- Seller information – company name, address and contact information.

- Buyer information – company name, address and contact information.

- Shipping method: road, rail, air or sea transport.

- Type of transportation – FCL, LCL, bulk or others.

- Port of loading and port of discharge (seaport or airport)

- Product descriptions – including product/item codes, number of units, unit type, price.

- Incoterms – agreed terms of delivery

- Any additional information – usually payment terms, order deadlines or estimated information about the vessel.

- Bank details – a pro forma invoice may include bank details requiring the buyer to make payment.

- Name, date and signature of the company’s authorized representative.