Incoterms

What are Incoterms?

Incoterms means international commercial terms for the delivery of goods. Incoterms are a codified set of standard contractual clauses relating to the transport of goods.

Developed by the International Chamber of Commerce (ICC) in 1936, Incoterms are revised every 10 years to reflect changes in international trade practices.

These customary rules codify the terms of delivery of goods under a sales contract.

In particular, Incoterms make it possible to determine the terms of delivery of goods sold: acceptance of transport, insurance, customs formalities, duties and taxes, obligations for customs clearance, transfer of risks.

How are Incoterms presented?

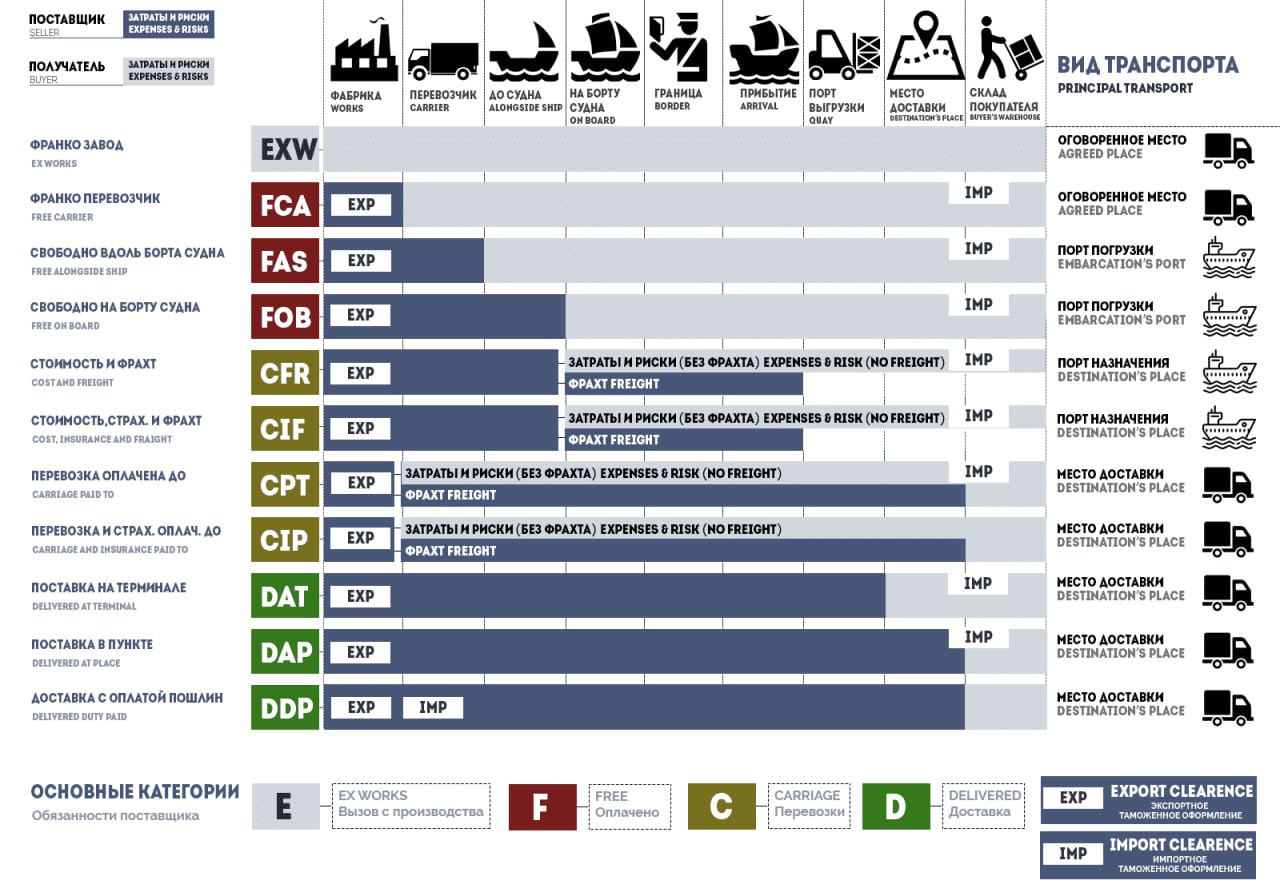

Incoterms are 11 rules, codified in three letters and divided into four groups, which establish the division of risks, responsibilities and costs between buyer and seller, regardless of the mode of transport used, country and carrier company. They are part of an international sales contract and determine the obligations of the seller on the one hand and the buyer on the other. They apply to goods, so intangible goods and services are not affected.

Group “E”: The seller is obliged to provide the goods to the buyer directly at his own premises.

Group “F”: The seller must deliver the goods to the primary carrier designated by the buyer. The seller does not bear the costs and risks of the main transportation.

Group “C”: The seller bears the costs of basic transportation to the named place, but does not bear the risk of loss or damage to the goods.

Group “D”: The seller bears all costs and risks of transporting the goods to the named destination.

Incoterms 2020

Coming into force on 1 January 2020, the new version, like the previous one, consists of 11 rules, which continue to be classified into four groups depending on the risks shared.

Multimodal transportation.

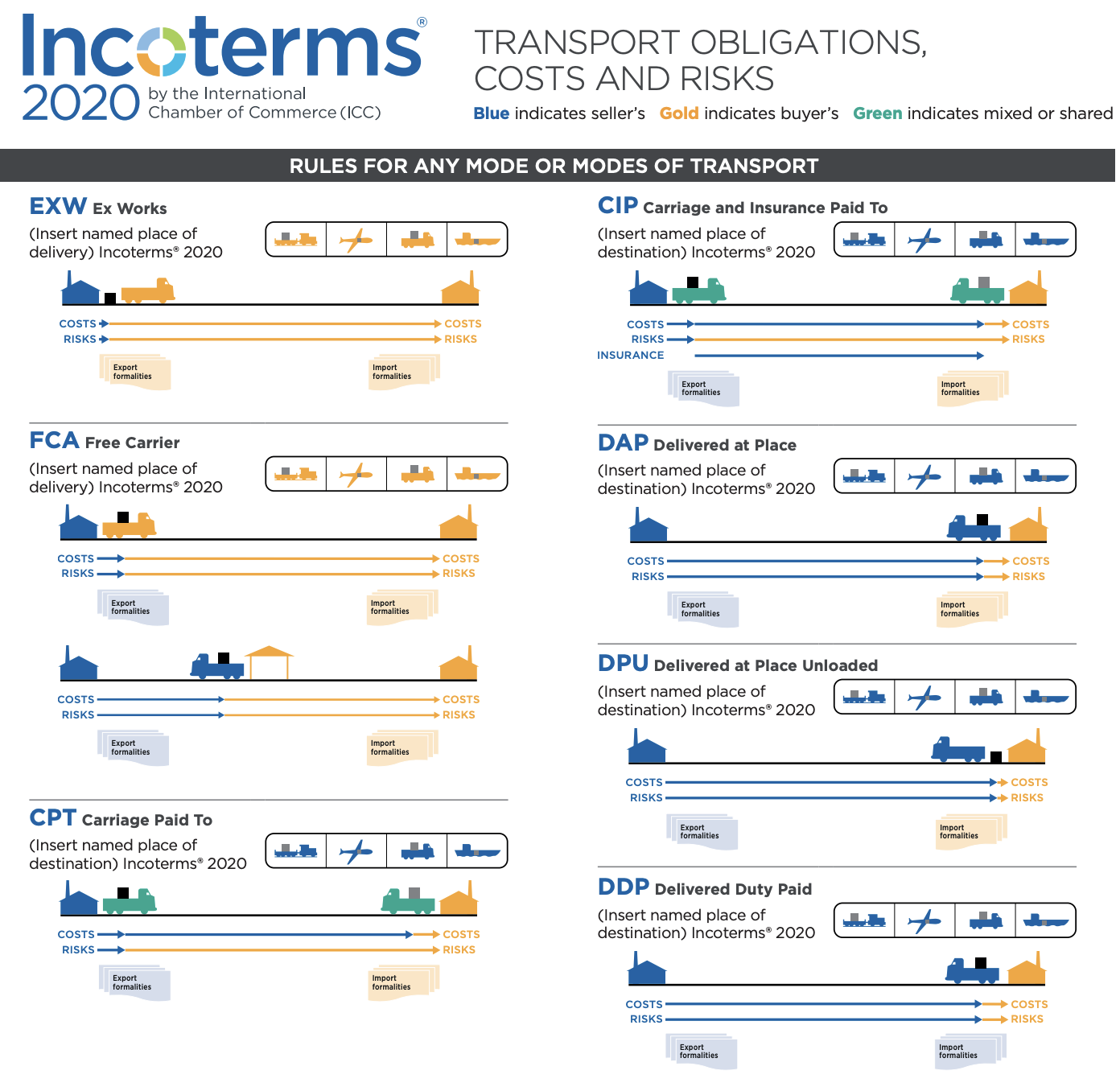

Multimodal transportation is applicable to all modes of transport, and can be used when the contract covers several modes of transport, which is especially important when transporting goods in containers.

Incoterms EXW and FCA

- EXW – Ex-factory

A rule that imposes the least obligation on the seller, whose sole responsibility is to package the goods and make them available to the buyer at his own facility. According to this rule, the buyer bears all costs and risks associated with loading and transporting the goods to their destination.

Since the buyer is responsible for export customs formalities, he may encounter difficulties in the seller’s country in obtaining confirmation of the departure of the goods.

For this reason, the ICC recommends that this rule be reserved for national or regional trade that does not involve the export of goods, and that preference be given to the FCA rule that the seller bears the formalities and costs of customs clearance.

- FCA – free carrier

Depending on the place of delivery, two options for these Incoterms are possible:

- at the seller’s premises, where the seller loads the goods onto the buyer’s vehicle (“seller’s premises” FCA);

- at any other place: the seller arranges for the goods to be delivered to the place of shipment, where they are made available to the carrier ready for unloading (FCA “other named place”).

According to this rule, the buyer pays most of the

transportation and is exempt from formalities in the country of export, for which the seller is responsible.

Incoterms CPT and CIP

- CPT – Carriage paid until

The seller bears the costs of transportation to the destination, and is no longer responsible for the goods, the delivery of which is carried out at the expense of the buyer. This is due to the fact that the transfer of risks occurs at the time of delivery, when the goods are transferred to the carrier, and the transfer of costs to the buyer occurs when the goods arrive at their destination.

- CIP – Carriage and Insurance Paid Before

The seller bears the costs of transportation to the destination specified in the Incoterms.

CIP is a commonly used rule, especially in container shipping, that allows control over the routing of goods to a given destination.

As with CPT, the costs of unloading at the agreed destination are borne by the seller only if provided for in the contract of carriage. However, unlike CPT, the seller is required to take out insurance to cover the risks

related to the transportation of goods to their destination.

Incoterms DAP, DPU and DDP.

According to Incoterms D rules, since delivery is made to the country of destination, the transfer of risk occurs there.

Under these so-called “Incoterms on Arrival”, the seller assumes all risks and costs associated with transporting the goods to their destination.

- DAP – delivery to location

These Incoterms mean that goods are considered delivered when they are made available to the buyer at their destination on an arriving means of transport without unloading. Under this rule, the seller is responsible for transporting the goods to the agreed delivery point in the country of destination.

Thus, unless otherwise provided in the contract of carriage, the buyer is responsible for customs clearance, duties and taxes due on importation, and unloading of the goods at destination.

- DPU – delivered to site unloaded

DPU replaces DAT 2010 and becomes the new Incoterms 2020 rule.

This rule means that the goods are considered delivered from the moment they are unloaded from the vehicle and placed at the disposal of the buyer at the agreed destination (terminal or other).

According to this Incoterms rule, delivery and arrival at destination occur at the same point. Thus, the seller bears all risks and costs associated with transporting the goods and unloading them at the agreed location.

DPU is the only Incoterms rule that obliges the seller to unload the goods at destination.

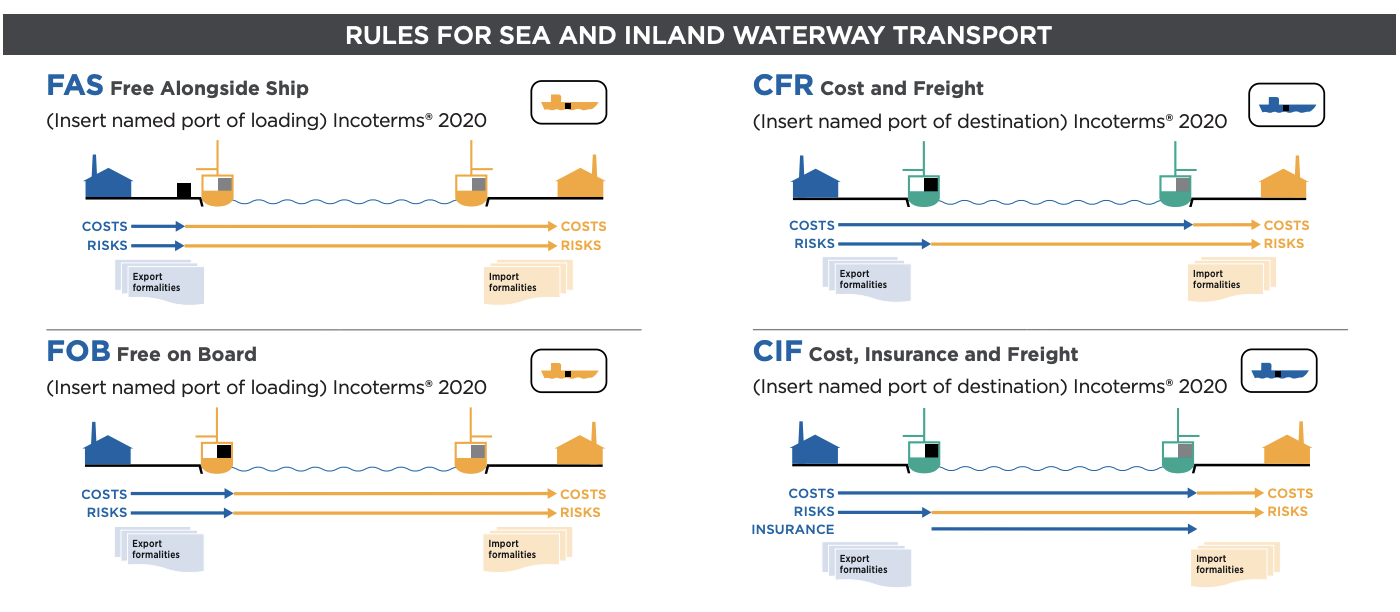

Marine Incoterms.

The four Incoterms are called “maritime” because they are intended to be used when the seller places the goods on board (or, in the case of FAS, near) a ship in a sea or inland port. It is believed that this is where the seller delivered the goods to the buyer.

In practice, maritime Incoterms are intended for the transport of goods in bulk, while container transport is specifically regulated by multimodal Incoterms.

Incoterms FAS and FOB.

- FAS – free next to the vessel

Costs (and risks) are transferred to the buyer when the goods are placed next to the ship (for example, on a quay) at the designated port of shipment.

Thus, the buyer bears all costs associated with the goods from the moment of delivery (loading, sea transportation and unloading of the vessel).

- FOB – free on board

The transfer of costs (and risks) occurs as soon as the goods are loaded on board the vessel nominated by the buyer at the agreed port of shipment.

Thus, unlike FAS, responsibility for loading the vessel lies with the seller.

Incoterms CFR and CIF

- CFR – cost and freight

Like multimodal C-rules, risk and cost transfer are separated. Risks pass to the buyer at the port of departure when the goods are delivered on board the ship, while costs are borne by the seller under the contract of carriage until the goods arrive at the agreed port of destination.

Thus, in principle, the costs of unloading the vessel, as well as the associated costs of handling the cargo, are borne by the buyer, unless otherwise provided in the contract of carriage.

- CIF – cost, insurance and freight

The equivalent of multimodal CIP, maritime CIF, differs in the required level of insurance coverage, which is more limited than all-risk CIP insurance.

However, insurance must cover at least the price of the item plus 10%.